News

2020

02 Oct 2020

EACT responds to European Commission consultation on an EU Green Bond Standard

The European Association of Corporate Treasurers (EACT) has published its response to the European Commission’s (EC) consultation on the creation of an EU Green Bond Standard (EU GBS).

View More30 Sep 2020

EACT Newsletter - September 2020

The latest issue looks at central bank digital currencies (CBDCs), communication in a digital world, and information regarding the new 2020 - 2021 Journeys to Treasury report.

View More29 Sep 2020

EACT Briefing Focus: Sustainable Finance

Sustainable finance and environmental, social and governance (ESG) reporting are becoming increasingly important topics for treasurers. This briefing sheds light on why and how sustainable finance should matter to all treasurers and explain the latest regulatory developments and initiatives at EU level.

View More21 Sep 2020

Journeys to Treasury 2020 – 2021: Innovation, Agility and Resilience

With the launch of the 2020-2021 report, following on from the special COVID-19 series earlier in the year, the Journeys to Treasury partners are helping treasurers globally at every step through a tumultuous journey.

View More16 Jul 2020

EACT responds to European Commission consultation on a Renewed Sustainable Finance Strategy

The EACT is grateful for the opportunity to respond to the European Commission's consultation on a renewed sustainable finance strategy. Read our position here.

View More01 Jul 2020

EACT announces Tarek Tranberg as Head of Public Affairs & Policy

Tarek is an experienced public affairs expert, specialising in EU financial regulation and has previously advised financial and non-financial companies across the entire financial services value chain on their EU policy advocacy strategies at FleishmanHillard. Tarek has a profound understanding of the regulatory issues impacting treasury and of the strategic objectives of the EACT.

View More29 Jun 2020

EACT supports the European Commission’s proposal for a new Digital Finance Strategy for Europe

Read the EACT's response to the European Commission's new digital finance strategy for Europe / FinTech action plan.

View More29 Jun 2020

EACT supports the European Commission’s development of an EU Retail Payments Strategy

The EACT is grateful for the opportunity to respond to the consultation on the implementation of new retail payments strategy. Read our position here.

View More25 Jun 2020

EACT Newsletter - June 2020

The latest issue looks at the results of the EACT Survey, FX hedging in volatile markets, and shares the latest news from EACT and its member associations.

View More30 Apr 2020

EACT Newsletter - April 2020

The latest issue looks at how to plan liquidity requirements during Covid-19, defend against fraud and cyberattacks, and shares the latest news from EACT and its member associations.

View More09 Apr 2020

Covid-19 Resource Centre

The Covid-19 pandemic is confronting all of us with new challenges. To help navigate some of the uncertainty, we have created a dedicated resource centre that takes you through some of the policy and regulatory measures that have been adopted or are being discussed at EU and international level.

View More26 Feb 2020

EACT Newsletter - February 2020

The latest issue examines the latest EU policy initiatives, assesses the impacts caused by interest rates below zero and reports on how European treasurers have joined forces on instant payments

View More29 Jan 2020

EACT Briefing Focus: Trade Finance Innovation

Trade Finance Innovation is a key topic for corporate treasurers. Recent decades have seen radical changes in the way we deal, shop, hedge, lend and pay, for example. Why shouldn't Trade Finance also deliver its full potential of transformation?

View More23 Jan 2020

EACT responds to European Commission consultation on implementing the final Basel III reforms in the EU

The EACT is grateful for the opportunity to respond to this consultation on the implementation of the final Basel agreement in the EU. Read our position here.

View More23 Jan 2020

EACT responds to ESMA consultation on review of the Market Abuse Regulation and potential extension of its scope to FX spot markets

View the EACT's responses to the questions asked in the Consultation Paper on the MAR review report, published on the ESMA website.

View More2019

19 Dec 2019

EACT Newsletter - December 2019

The latest issue features updates on what the new EU policy cycle for 2019-2024 will likely hold in store for financial services and corporate treasury, as well as event updates from various national associations.

View More28 Oct 2019

EACT Newsletter - October 2019

The latest issue features updates on the new Journeys to Treasury report, EURIBOR and EONIA benchmarks and how to benefit from the EMIR Refit.

View More16 Oct 2019

Journeys to Treasury 2019-2020: Shaping the Treasury of 2025

We invite you to download the 2019-2020 edition of Journeys To Treasury and discover rich, diverse insights on the trends, challenges and priorities that are shaping best practices in treasury both today and in the future.

View More16 Jul 2019

Vision on financial regulation for the real economy for the next 5 years

Corporate treasurers are financial specialists within non-financial companies - but as end-users they are often impacted by EU legislation aimed at the financial sector.

View More20 Jun 2019

EACT Newsletter - June 2019

The latest issue features articles on the European Parliament elections, the trade war between China and the USA, bank account management in transition plus the news that Helmut Schnabel has been re-elected Chair of IGTA.

View More29 Apr 2019

EACT Newsletter - April 2019

The latest issue features articles on cryptocurrencies in the Czech financial market, cybersecurity, impacts of M&A on hedging operations and much more.

View More26 Mar 2019

EACT Newsletter - March 2019

The newsletter features a series of special reports on the EACT Summit 2019.

View More14 Mar 2019

EACT Briefing Focus: KYC

KYC has become a serious concern for EACT members over recent years: it is increasingly complex to fulfil all unstructured and nonharmonized requests. In all recent surveys, KYC is listed as a top priority for corporates and its rising costs are a source of frustration.

View More01 Feb 2019

EACT Newsletter - February 2019

The newsletter features articles on Brexit, tackling cyber risks in treasury and reports on recent NTA events.

View More2018

12 Dec 2018

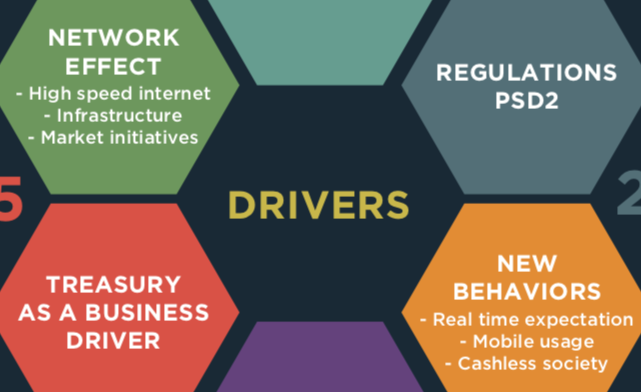

EACT Briefing Focus: Instant Payment

SEPA Instant Payment, an innovative instrument launched in Nov. 2017 by the European Payments Council currently has 2500+ participating banks. It provides corporate treasurers with both a business enabler and an opportunity to improve internal processes and gain efficiencies.

View More10 Dec 2018

EACT Newsletter - December 2018

The newsletter features articles about the changing Euro interest benchmark landscape, the implications of Brexit on the derivatives markets, new Schuldschein loan agreements, the latest regulatory updates and more.

View More28 Sep 2018

EACT Newsletter - September 2018

The newsletter features articles about the new Journeys to Treasury report, SWIFT gpi, the latest regulatory updates and more.

View More28 Sep 2018

Journeys to Treasury 2018: The Digital Treasury Becomes a Reality

Journeys to Treasury 2018 explores the digital treasury in practice, and how leading treasurers are protecting, empowering and adding value to the business using innovative technologies and banking services.

View More24 Sep 2018

EACT Briefing Focus: SWIFT gpi

SWIFT gpi will significantly improve international payment processes and address many of the issues treasurers are facing today. Read this special EACT briefing to find out more.

View More26 Jul 2018

EACT Newsletter - July 2018

The newsletter features articles about the Treasury headcounts benchmarking survey, FX Global Code and more.

View More12 Jul 2018

The EACT launches a register for corporates adhering to the FX Global Code

The European Association of Corporate Treasurers (EACT) has today launched a register for corporates adhering to the FX Global Code. Since its drafting phases, the EACT has supported the FX Global Code, which is a set of global principles of good practice in the foreign exchange market published in May 2017.

View More05 Jul 2018

EACT Summit 2018 Magazine

A digital magazine summarising the second EACT Summit, which took place in Brussels in March 2018.

View More02 Jul 2018

Is your company protected from cyber threats?

Treasurers need to ensure that controls are in place to protect the corporate assets and, as such, should take a lead role in protecting the company from cyber threats.

View More29 May 2018

EACT Newsletter - May 2018

The newsletter features articles on protecting your company from cyber threats, new members of the EACT, the latest regulatory updates and the EACT's new privacy policy.

View More17 Apr 2018

EACT Newsletter - April 2018

The newsletter features highlights of the EACT 2018 Summit, including how should companies be preparing Brexit, how to encourage diversity and inclusion in the world of corporate treasury and much more.

View More22 Mar 2018

The EACT enlarges its membership with Austrian and Romanian treasury associations joining

The European Association of Corporate Treasurers (EACT) Board unanimously voted to welcome the Austrian Corporate Treasury Association (ACTA) and the Romanian Treasury Association (Asociatia Trezorierilor din România, ATR) as new members.

View More16 Jan 2018

EACT Newsletter - January 2018

The newsletter features discussions around: trust and the distributed ledgers creations; payments: what's new?; 2017 AFTE Days; joint EACT-IGTA annual meeting; plus upcoming events and the latest regulatory updates.

View More2017

06 Dec 2017

EACT MiFID 2 Webinar recording and slides now available

The webinar took place on 1 December and focused on the impact that MiFID 2 will have on non-financial corporates.

View More04 Oct 2017

Corporates steer Journeys to Treasury 2017: spotlight on data analytics, compliance and cybersecurity

BNP Paribas, the European Association of Corporate Treasurers (EACT), PwC and SAP have launched the second edition of ‘Journeys to Treasury’ (JTT), a collection of hands-on conversations about treasury today and tomorrow made with and for treasurers.

View More02 Oct 2017

EACT Newsletter - October 2017

The October 2017 newsletter includes: the launch of Journeys to Treasury 2017; ATEL on IFRS 9 on Hedge Accounting; ACT discussing green finance; plus recent EACT positions, publications and the latest regulatory updates.

View More22 Sep 2017

Joint Non-Financial Corporates Letter on EMIR Reporting RTSs

The EACT, the EuropeanIssuers and the US Coalition of Derivatives End-Users have sent a joint letter to the European Commission and ESMA requesting a postponement in the application of the revised Regulatory Technical Standards for EMIR reporting that will enter into force in November, due to the proposed changes in EMIR reporting obligations in the EMIR Refit review.

View More19 Sep 2017

EMIR Refit Proposals: Impact On Corporate End-Users

The EACT, together with other corporate end-user associations, has issued a position paper outlining our priorities for the EMIR REFIT review. These include maintaining the current hedging exemption, making some changes to the proposed reporting structure and extending the proposed asset class by asset class assessment of the clearing obligation to bilateral margin requirements.

View More05 Jul 2017

Letter to EPC: Remittance Information for SEPA Payments

Five business end-user associations, including the EACT, have addressed a letter to the European Payments Council (EPC) concerning the changes needed in SEPA remittance information. The letter highlights the need for extended remittance information and the need to include such extended remittance information within the existing payment messages.

View More16 Jun 2017

EACT Response to the European Commission's consultation on FinTech: a more competitive and innovative European financial sector

The European Association of Corporate Treasurers (EACT) has responded to the European Commission's consultation on FinTech. In our response we highlight the use cases and benefits of FinTech for corporates and comment on other aspects of FinTech's evolution.

View More07 Jun 2017

EACT Newsletter - June 2017

The June 2017 newsletter features: Richard Cordero, Chief Operating Office, with an overview of the EACT Summit; DACT offer advice on reducing banking transaction costs; ACT discuss why the voice of treasury is critical in business and how best to be an advocate for treasury skills; plus regulatory updates, open consultations & updates from EACT members.

View More25 May 2017

The EACT welcomes the adoption of the Global FX Code of Conduct

The European Association of Corporate Treasurers (EACT) welcomes today's publication of the Global Code of Conduct for the Foreign Exchange Market. We strongly support the Code and its objective of strengthening the integrity and the effectiveness of the FX market, which is essential to corporate treasurers.

View More24 May 2017

EACT Summit newsletter - May 2017

A special version of the EACT newsletter summarising the first ever EACT Summit, which took place in Brussels in March 2017.

View More17 May 2017

EACT response to the EC's consultation on the operations of the European Supervisory Authorities

The EACT has responded to the European Commission's consultation on the operations of the European Supervisory Authorities (ESAs).

View More04 May 2017

EMIR Review: Corporate End-User Statement

The EACT, together with other corporate end-user associations, has welcomed the European Commission's proposal for EMIR review as an important step forward in reducing burdens on corporates.

View More31 Mar 2017

Response to the European Commission's Consultation on CMU Mid-Term Review

The EACT has responded to the European Commission's consultation on Capital Markets Mid-Term Review. In this response we address certain specific aspects that we believe should be taken into consideration in the future and on-going work on CMU, in particular concerning work on corporate bond market liquidity.

View More31 Jan 2017

EACT Newsletter - January 2017

The January 2017 newsletter includes updates on derivatives regulation, capital requirements, EU money market funds regulation and a new EPC payments scheme.

View More2016

06 Dec 2016

Corporate End-User Comments on EC EMIR Review Report

The EACT - together with other associations representing corporate end-users of derivatives - has commented on the recent report issued by the European Commission concerning its forthcoming review of EMIR.

View More06 Dec 2016

EACT Response to ESMA Consultation on Draft Regulatory Technical Standards for the Securities Financing Transactions Regulation (SFTR)

EACT has submitted a response to ESMA's consultation on the draft Regulatory Technical Standards for the Securities Financing Transactions Regulation (SFTR), that mandates double-sided reporting for non-financial corporates entering into repo transactions.

View More14 Nov 2016

EACT Letter on MMF Regulation Trilogues

The EACT has addressed a letter to European Parliament members, the Slovak Presidency and the European Commission concerning the discussions aiming to finalise the Money Market Fund reforms. In our letter we emphasise amongst others the importance of maintaining CNAV government debt funds as they are an important cash management tool for a number of corporates.

View More17 Oct 2016

Journeys to Treasury / Digital report

EACT, BNP Paribas, PwC and SAP joined forces to launch 'Journeys to Treasury', a cutting-edge report that is designed to help professional treasurers build their own journey to the future of treasury. The first edition of Journeys to Treasury addresses three key topics for corporate treasurers: continued innovation; anytime, anywhere treasury; cybercrime and fraud.

View More12 Oct 2016

BNP Paribas, EACT, PwC and SAP join forces to help corporate treasurers design their own journey to treasury

The first edition of JTT addresses three key topics for corporate treasurers: continued innovation; anytime, anywhere treasury; and cybercrime and fraud. Diving deeper into the report, game changers like blockchain, fintechs, immediate payments and big data will bring together the joint insights of the bank, the industry association, the consultant and the software vendor.

View More08 Sep 2016

Letter to Basel Committee on Changes to Leverage Ratio Framework

The EACT has addressed a letter to the Basel Committee on Banking Supervision concerning the ongoing review of the leverage ratio. We discuss the impact of the leverage ratio on cash pooling structures commonly used by non-financial companies and request the Committee to reconsider the rules so that these companies can continue to use both notional and physical cash pooling solutions.

View More08 Sep 2016

Letter to Basel Committee on Reducing Variation in Credit Risk-Weighted Assets

The EACT has addressed a letter to the Basel Committee on Banking Supervision concerning the proposed review of banks' use of internal models. With our letter we seek to highlight our concerns that the proposals, if implemented, would lead to a considerable increase in EU banks' capital needs, and could therefore lead to significant price increases and withdrawal of certain banking products and services.

View More06 Sep 2016

Response to EMSA consultation on the clearing obligation for financial counterparties with a limited volume of activity

The EACT has responded to the European Securities Markets Authority's consultation on the clearing obligation for financial counterparties with limited volume of activity. ESMA is proposing a delay to the start of the clearing obligation for small financial counterparties. We highlight in our response the need to extend such a delay to the non-financial counterparties subject to the clearing obligation (NFC+s).

View More01 Jul 2016

EACT Chair appointed to ESMA's new Securities and Markets Stakeholder Group

The European Securities and Markets Authority (ESMA) has published the new list of members of its Securities and Markets Stakeholder Group (SMSG) and the EACT are delighted to confirm that Jean-Marc Servat, EACT Chair, is among the individuals who have been selected to represent financial market participants. He will begin a 2-year term on 1 July 2016.

View More28 Jun 2016

Response to Net Stable Funding Ratio (NSFR) Consultation

The EACT has responded to the European Commission's consultation on the implementation of the Net Stable Funding Ratio (NSFR) in the EU. In this response letter, we highlight our concerns on the possible impacts of some elements of the Basel Committee's NSFR standard on the cost and use of derivatives by non-financial companies.

View More23 Jun 2016

Briefing Paper on Planned Changes to the ECB FX Reference Rates

This EACT paper briefly describes the changes taking place as of 1 July on the ECB foreign exchange reference rates and the impact on treasurers.

View More01 Apr 2016

MiFID2: Clarification for non-financial end-users transacting on multilateral electronic trading platforms

The EACT has sent a letter to the European Parliament asking for a clarification of MiFID 2 so that non-financial companies transacting on their own account on electronic trading platforms continue to be exempt from MiFID licensing requirements.

View More15 Feb 2016

EACT Response to the European Bank Authority's Consultation on the Treatment of CVA under SREP

The EACT has responded to the European Banking Authority's consultation on the treatment of CVA risk under the supervisory review and evaluation process (SREP). In our response we highlight that the EBA's mandate for issuing the proposed guidelines is questionable and that applying the guidelines would partially eliminate the exemption from CVA risk charge from which non-financial counterparties are benefitting under CRR.

View More01 Feb 2016

EACT Response to EC Call for Evidence on EU Regulatory Framework for Financial Services

The EACT has responded to the European Commission's call for evidence on the EU regulatory framework for financial services, which aims at assessing the impact of the EU financial reform since 2009. The significant wave of financial regulation has concentrated on ensuring financial stability and on reducing the likelihood of a similar crisis reoccurring.

View More2015

07 Dec 2015

Press Release: Leading European companies unite against proposals damaging financial risk management

Nearly 90 non-financial companies operating in the EU have addressed a letter to the Chair and the Board of Supervisors of the European Banking Authority to call for abandoning planned measures that would have serious negative impacts on non-financial companies' ability to manage their financial and business risks. The letter has been prepared by the European Association of Corporate Treasurers.

View More07 Oct 2015

EACT Position on ESMA Report on Use of OTC Derivatives by Non-Financial Counterparties

The EACT has published a position statement on the report by the European Securities and Markets Authority (ESMA) on the use of OTC derivatives by non-financial counterparties. We are very concerned by ESMA's recommendation to remove the hedging exemption currently part of the EMIR Regulation, as hedging plays an important economic role and removing the exemption would have severe consequences on companies in the real economy.

View More30 Sep 2015

EACT Response to BCBS consultative document on Review of the Credit Valuation Adjustment Risk Framework

The EACT has responded to a consultation by the Basel Committee on Banking Supervision (BCBS) on the Review of the Credit Valuation Adjustment (CVA) risk framework. We argue that the BCBS should adopt a similar approach to that currently in place in the EU, whereby non-financial counterparties' hedging transactions are exempted from the calculation of CVA risk capital charges.

View More13 Aug 2015

EACT Response to European Commission Consultation on EMIR

The EACT has submitted its response on the European Commission's public consultation on the EMIR Regulation. We call for the review of the current legislation and urge the Commission to adopt changes to ease the burden of the Regulation on non-financial counterparties. These changes include amongst others adopting single-sided reporting abandoning the requirement to report intra-group transactions.

View More13 Aug 2015

EACT Survey Report on Cost of EMIR Compliance

The EACT has published the results of a survey conducted on the cost of EMIR compliance on non-financial counterparties. The objective of the survey was to gather data on the exact costs borne by companies subject to EMIR and to better understand the difficulties faced with implementation. The results of the survey will also support our engagement with policy makers as the discussion on EMIR review moves forward.

View More03 Aug 2015

EACT Statement on the EBA Review of the CRR CVA exemption

The EACT has issued a statement criticising the European Banking Authority's (EBA) report on the application of Credit Valuation Adjustment (CVA) risk capital charge exemptions in the Capital Requirements Regulation (CRR). The EACT strongly disagrees with the EBA analysis and conclusions and objects to EBA plans to impose additional capital charges on CVA-exempted transactions.

View More30 Jun 2015

EACT Announces Jean-Marc Servat as New Chairman

With effect from 1 July 2015 Jean-Marc Servat takes over from Richard Raeburn as Chairman of the European Association of Corporate Treasurers (EACT). Richard is retiring from the role after more than seven years leading the EACT.

View More14 May 2015

EACT Response to European Commission Green Paper on Building a Capital Markets Union

The EACT has submitted its response to the European Commission's consultation on Building a Capital Markets Union (CMU). EACT Chairman Richard Raeburn said: "CMU is a long-term project that we fully support. Its relevance is primarily for mid-size companies rather than the very large and very small. CMU can play a key role in stimulating growth and employment but the Commission needs to balance its short and long term policy responses."

View More11 May 2015

EACT Response to the European Commission's Consultation on Capital Markets Union

The EACT has responded to the European Commission's consultation on building a Capital Markets Union (CMU). Our response to this very large consultation highlights in general our wish to see the needs of non-financial end-users being put in the centre of future policy considerations in order to have in place a framework of financial regulation that helps non-financial companies to conduct their business.

View More11 May 2015

EACT Letter to the European Commission on the definition of FX derivatives

The EACT has sent a letter to the European Commission concerning the work currently undertaken on the definition of foreign exchange (FX) derivative instruments under the delegated acts of MiFID 2.

View More01 Apr 2015

EACT Comment on ESMA Call for Evidence

The EACT has commented on ESMA's call for evidence on competition, choice and conflicts of interest in the CRA industry. The EACT response highlights that we do not see a need to review the legislation currently in place, as the regulation on CRAs has gone through an extensive review in the recent years.

View More20 Mar 2015

EACT Letter to ECON Rapporteur Gunnar Hokmark

The EACT has sent a letter to the ECON Rapporteur Gunnar Hokmark and certain other ECON Committee members concerning the ongoing negotiations on the Bank Structural Reform. With this letter we would like to draw the MEPs' attention to some aspects of the proposed reform which would be detrimental to the real economy, in particular the proposed restrictions to the availability of OTC derivatives and market making.

View More10 Mar 2015

EACT Survey: the Cost of EMIR Compliance for Non-Financial Companies

The EACT is running a survey until 30 April on the costs of European Markets Infrastructure Regulation (EMIR) on non-financial companies. The purpose of this survey is to get an overview on the cost that the compliance with the obligations laid down in EMIR has had on non-financial companies to date.

View More02 Mar 2015

EACT Response to ESMA Consultation Paper on MiFID II / MiFIR

The EACT has responded on ESMA's consultation on level 2 measures for MiFID 2 / MiFIR. In our response we make some general comments on the transparency requirements for non-equity transactions, the trading obligation, the use of direct electronic access to trading platforms and the classification of FX transactions.

View More26 Feb 2015

EACT Statement on ECON Position on MMF Regulation

The European Association of Corporate Treasurers (EACT) welcomes the position reached today in the ECON Committee on the Proposal for regulating Money Market Funds. We congratulate Rapporteur Neena Gill and Shadow Rapporteurs Brian Hayes, Syed Kamall, Petr Jezek, Fabio De Masi and Philippe Lamberts for their good work and for bringing the negotiations within ECON to a successful result.

View More17 Feb 2015

European Commission Green Paper on Building a Capital Markets Union

The European Association of Corporate Treasurers (EACT) welcomes the Commission's Green Paper on Building a Capital Markets Union. We think this is an important and much needed initiative from the Commission. Europe is in serious need of action to support its companies with efficient and well-functioning capital markets. The recent programme of financial regulation has concentrated on ensuring financial stability and on preventing a new crisis.

View More17 Feb 2015

The Real Impact of Derivatives Regulation: Time to Challenge ESMA with the Realities?

by Richard Raeburn, EACT Chairman. ESMA invited comments on the technical standards for reporting under article 9 of EMIR. I sense that amongst corporate practitioners there is a profound sense of weariness - a weariness borne not just out of the volume of work created for them but also the sheer frustration of dealing with the uncertainties and inconsistencies that dog the implementation of at least the trade reporting aspects of EMIR.

View More16 Feb 2015

EACT Response to ESMA's Consultation on the technical standards on reporting under Article 9 of EMIR

The EACT has submitted a response to the European Securities and Markets Authority's (ESMA) consultation on the technical standards on reporting under Article 9 of EMIR. We are supportive of ESMA's efforts to provide enhancements that will clarify and simplify reporting requirements but we highlight that sufficient lead-time for implementation by non-financial counterparts must be foreseen.

View More2014

19 Dec 2014

Feedback on the Position Paper on the Evolution of ICE LIBOR

The EACT responded to the ICE Position Paper on the Evolution of ICE LIBOR. The EACT response highlights that financial benchmarks such as LIBOR are used extensively by non-financial companies in relation to their financing and risk management and as well as in many commercial contracts. Therefore the continued availability of reliable financial benchmarks is critically important for the real economy.

View More18 Nov 2014

EACT Letter on CRD IV CVA Exemption

The EACT has sent a letter to the European Banking Authority (EBA) concerning the work currently undertaken by the EBA on the implementing measures of the Capital Requirements Regulation, and in particular the work carried out concerning the Credit Valuation Adjustment (CVA) risk capital charge calculation.

View More31 Oct 2014

EACT complaint to EU Ombudsman regarding main ESMA stakeholder group

EACT filed an official complaint to the European Ombudsman in March 2014 concerning the composition of the European Securities and Markets Authority's (ESMA) main stakeholder group, the Securities and Markets Stakeholder Group (SMSG). The SMSG helps facilitate consultation by ESMA with stakeholders in areas relevant to ESMA's tasks such as the development of technical standards and guidelines.

View More31 Oct 2014

EMIR implementation for corporates: issues with Trade Repositories' new requirements

The EACT is writing to raise ESMA's attention to the difficulties that companies have been and still are facing when implementing the new changes to the reporting files requested by the trade repositories. It should be noted that as a result many companies will fail to meet the 1st December 2014 deadline which is currently being imposed on them by the TRs.

View More25 Sep 2014

Influence Financial Regulation in Brussels on Behalf of Treasurers and the Real Economy

The EACT has established a strong reputation in Brussels for the quality of its response to regulatory and legislative initiatives that impact the treasury profession. This work has been and remains particularly important in dealing with the financial regulatory responses to the financial crises. We now plan to strengthen our capability by appointing a Policy Director to work with our existing Permanent Representative in Brussels.

View More01 Sep 2014

EACT Briefing Paper for MEPs

The EACT has drafted a briefing paper for the new Members of the European Parliament and in particular the members of the ECON Committee dealing with financial services legislation.

View More01 Sep 2014

EACT Position Statement on European Commission Proposal for Bank Structure Reform

The EACT has published its position paper on the European Commission's proposal for Regulation on structural measures to improve the resilience of EU credit institutions which deals with the structural reform of the EU banking sector. We stress that we are not convinced of the need to introduce a fundamental separation of banking activities as proposed by the Commission.

View More14 Jul 2014

EACT Response to the Consultation on Margin Requirements

The EACT has responded to a joint consultation held by the European Supervisory Authorities on the risk-mitigation techniques for OTC-derivative contracts not cleared by a CCP.

View More20 Jun 2014

The EACT & Reval invite you to participate in the Treasury Benchmarking Survey 2014

The objectives of the survey are to understand why treasury is changing and how technology can support treasury in this change process. It should not take more than 10 minutes to complete the survey, which covers the following areas:

View More09 May 2014

Response to the European Commission consultation on foreign exchange financial instruments

The EACT has responded to the European Commission's consultation on foreign exchange instruments. The response highlights that FX transactions undertaken for commercial purposes by non-financial companies should not be considered as financial instruments under MiFID as such transactions promote rather than threaten financial stability.

View More09 May 2014

EACT Comments on the Commission Proposal for Payment Services Directive II

The EACT has published a position paper on the Commission's proposal for a revised Payment Services Directive.

View More07 Mar 2014

EACT letter to Commissioner Barnier on EMIR implementation

Immediately before the EMIR reporting start date of 12 February the EACT sent a letter to the Internal Market Commissioner Michel Barnier stressing the numerous difficulties faced by non-financial counterparties in implementing the EMIR reporting obligation; we requested that the national supervisors adopt a flexible approach in the first months of reporting.

View More03 Mar 2014

Response to the Financial Stability Board's Consultation on the Feasibility Study on Approaches to Aggregate OTC Derivatives Data

The EACT has responded to a consultation by the FSB on the issues associated with the aggregation of data held by trade repositories. "We make the point that there is a risk that the aggregation of derivatives reporting data will be seen principally as a technical challenge instead of a challenge relating to the international inconsistency of the new regulatory requirements in respect of the reporting of OTC derivatives."

View More16 Jan 2014

EACT Letter on Capital Market Funding

The EACT has sent a letter to key EU decision-makers on the importance of ensuring continued access to capital market funding for European corporates. We currently see that whilst reducing reliance on bank funding and increasing the role of capital markets is a stated: EU policy objective, in practice current legislative initiatives are not always supportive of this.

View More2013

31 Oct 2013

Position Statement on the EU's Proposed Money Market Funds Regulation

The EACT has published a position statement commenting on the EU's proposed Money Market Funds regulation. The EACT argues that for the real economy there is one fundamental flaw in the proposal - the bar on the use of external credit ratings.

View More18 Sep 2013

Taming the Money Market Beast (a Financial Times Video)

Richard Raeburn, Chairman of the European Association of Corporate Treasurers, explains to Madison Marriage of the Financial Times why European corporates could lose out as a result of the new Money Market Fund Regulation recently unveiled by the European Commission.

View More31 Jul 2013

European Commission consultation on the Review of the European System of Financial Supervision

The EACT has responded to the European Commission consultation on the Review of the European System of Financial Supervision. Our response underlines the urgent need to review the stakeholder representation within the European Supervisory Authorities (ESAs) and in particular the European Securities and Markets Authority (ESMA), in order to allow for more balanced and more relevant stakeholder representation.

View More17 Jul 2013

Letter on Cross-Border Derivatives Regulation

Just as the EU and US were agreeing their approach to cross-border supervision of swaps trading, the EACT and the U.S. Coalition for Derivatives End-Users jointly wrote to global regulators including Mark Carney (FSB) and Greg Medcraft (IOSCO) arguing the need for global regulation of cross border derivatives to incorporate key principles for the global end user community.

View More16 Jul 2013

Consultation on Reforming the Structure of the EU Banking Sector

The EACT has responded to the European Commission's consultation on reforming the structure of the EU banking sector, in which a possible separation of retail and investment banking activities is envisaged.

View More16 Jul 2013

Green Paper on Long-term Financing of the European Economy

The EACT has submitted its response to the European Commission's consultation on the long-term financing of the European economy. The response underlines some essential elements of financial regulation that we feel the legislator should consider in all current and future actions and policies in order to make Europe a competitive and appealing place to both conduct and grow business.

View More01 Jul 2013

EACT Letter to JP Morgan Regarding Position on CVA Exemption

Securing the exemption from CVA charges in the new bank capital rules within the EU was a crucial element of the EACT's campaign to ensure that OTC derivatives continued to be available to corporates for risk management and that the pricing remained competitive. Policy in the United States towards the CVA exemption has been and remains a concern to the EACT.

View More17 Jun 2013

EACT Response to ECON Consultation on Coherence of Financial Services Regulation (June 2013)

The EACT has contributed to the European Parliament Economic and Monetary Affairs (ECON) Committee's public consultation on the coherence of financial services regulation.

View More31 May 2013

The Impact of the Financial Crisis on Bank Relationships and Financing Conditions

The EACT (European Association of Corporate Treasurers) releases the results of its annual survey of funding conditions for European companies. This confirms that whilst there are clear signs of improvement, companies still struggle to support their contribution to economic recovery with good access to bank finance. We hope you will be interested to see the short summary, which is supported by the detailed results.

View More14 May 2013

Comments concerning the Proposal for a Council Directive implementing enhanced cooperation in the area of a financial transaction tax

The EACT has issued a position paper on the proposal for a Council Directive implementing enhanced cooperation in the area of a financial transaction tax (FTT). We believe that the FTT would have a serious unintended consequence - its negative impact on European companies as well as pension funds and individuals, by for example increasing the cost of funding and managing business risks and tightening credit conditions.

View More19 Mar 2013

EACT & US Coalition for Derivatives End-Users submit responses to the BIS-IOSCO Consultations on Margin Requirements for Non-centrally-cleared Derivatives

The EACT has, together with the US Coalition for Derivatives End-Users, submitted responses to the BIS-IOSCO Consultations on Margin Requirements for Non-centrally-cleared Derivatives. The responses highlight that non-financial end-users should be exempt from mandatory margining requirements for OTC derivative trades or only be required to post margin above a certain threshold.

View More19 Mar 2013

EACT Letter to Internal Market Commissioner Michel Barnier

The EACT has addressed a letter to the Internal Market Commissioner Michel Barnier in order to highlight the need for a structural dialogue between real economy representatives and the regulators, in particular the European Securities and Market Authority (ESMA).

View More2012

05 Sep 2012

EACT makes its submission to the UK government's LIBOR review

The EACT highlights the governance weaknesses associated with the LIBOR process and its support for regulatory oversight and the threat legal sanctions to deal with any future manipulation. We highlight that any replacement for LIBOR must provide for continuity and not disadvantage companies with LIBOR-based contracts.

View More06 Aug 2012

Comments in response to ESMA consultation paper: Draft Technical Standards for the Regulation on OTC Derivatives, CCPs and Trade Repositories

The EACT welcomes the work done by ESMA to develop the draft technical standards covered by this consultation paper. In the aim of providing the most constructive support to ESMA we are limiting our comments to the areas of most concern in the drafting. In all cases the views we express are done so from the position of non-financial counterparties, in other words the real economy end-users of the financial system.

View More12 Apr 2012

EACT Response to EC Green Paper (

The EACT has offered a response to the recent EC Green Paper "Towards an Integrated European Market for Card, Internet and Mobile Payments". We applaud the EC's policy to inform stakeholders and increasingly engage them in the creation of new legislation and the governance of basic network services and infrastructures like payments. We also believe the Green Paper consultation to be an important step forward to enlarge and reinforce SEPA.

View More03 Apr 2012

EACT Response to ESMA/EBA/EIOPA discussion paper on risk mitigation techniques for OTC derivatives

The EACT has responded to the discussion paper from ESMA/EBA/EIOPA on risk mitigation techniques for OTC derivatives. "The crucial areas covered by the document concern the potential requirements for collateral on OTC derivative transactions by corporates - 'where the corporate concerned is above the 'clearing threshold' and the contracts cannot be cleared through a CCP.

View More19 Mar 2012

EACT response to ESMA consultation on the implementation of the new derivatives regulation

The EACT has made a submission to the European Securities and Markets Authority (ESMA) on some fundamental issues in the Level 2 implementation of the new regulation of derivatives (EMIR). The EACT's document addresses areas of crucial importance to corporate treasurers, including the definition of derivative positions that will meet the test for exemption from central clearing and the working of the clearing threshold.

View More07 Mar 2012

EACT Response to ESMA Consultation Paper Guidelines on certain aspects of the MiFID suitability requirements

The EACT have responded to the ESMA Consultation Paper Guidelines on certain aspects of the MiFID suitability requirements (ESMA/2011/445).

View More28 Feb 2012

EACT Comment on Latest EU Proposals for Regulation of Credit Rating Agencies, and ECON report

The EACT has commented on the latest EU proposals for regulation of credit rating agencies and the report of ECON in Parliament on these. The EACT believes that some of the measures proposed by the Commission would have material negative consequences on the use of ratings by corporate issuers, the real economy participants in the rating process.

View More06 Feb 2012

EACT Chairman's Presentation to ECON committee of the European Parliament on the subject of the Financial Transaction Tax (FTT)

The EACT's Chairman, Richard Raeburn, was invited to give evidence to the ECON committee of the European Parliament on 6 February 2011, on the subject of the Financial Transaction Tax (FTT). The proposal raises a number of issues that are political in nature, on which the EACT will of course not engage.

View More2011

07 Nov 2011

EACT highlights European Union's failure to consider real economic impact of financial regulatory proposals

The European Association of Corporate Treasurers (EACT) has sent an open letter to the Commissioners of the European Union, expressing grave concern over how, in its development of financial regulatory proposals, Brussels takes account of their impact on employment, growth and stability in the real economy. The letter has been signed by 188 European companies and its release follows that of a similar letter in January 2010.

View More11 Oct 2011

EACT Chairman's Presentation to Committee on Economic and Monetary Affairs of the European Parliament, 11 October 2011

EACT Chairman Richard Raeburn was invited to give evidence on the EU's proposals for bank capital requirements (CRD IV), at a meeting of the ECON committee of the European Parliament on 11 October 2011. In his speech he argues that it is vital that the new capital requirements regime does not cut across the value of the exemption won for corporate use of derivatives in the proposed EMIR regulation.

View More30 Jun 2011

Comments in response to European Commission's questions on SEPA governance (email from MARKT-SEPA@ec.europa.eu dated 23 June 2011)

The EACT has for some time been pushing for the European Commission and the ECB to reassess the quality of governance of the SEPA process. The issue was raised as an agenda item at the most recent SEPA Council meeting, where the EACT Chairman Richard Raeburn represents both the EACT and Business Europe.

View More24 Mar 2011

EACT Formatting Rules of SEPA "Unstructured" 140 Characters Field for Remittance Information

The EACT standard "will supply you with the instructions for populating the SEPA 140 characters remittance reference in a standard way. This way has been jointly approved by EACT, BUSINESSEUROPE & UEAPME as well as the EUROPEAN PAYMENTS COUNCIL."You can download the EACT Standard for Remittance Info here.

View More07 Mar 2011

EACT Comment in Response to IASB ED/2010/13: Hedge Accounting

The EACT has submitted a comment letter in response to the IASB's consultation on hedge accounting; this is part of the overall work being done to replace IAS 39 and therefore a major project of great concern to corporate treasurers. Our comment is broadly supportive of the IASB's proposals but we emphasise changes that should be met in order to reinforce the practical relevance of the new standard as to how treasurers actually manage risk.

View More01 Feb 2011

EACT Response to EC on Markets in Financial Instruments Directive (MiFID)

The EACT has responded to the latest consultation by the European Commission on Markets in Financial Instruments Directive (MiFID). This work will eventually lead to a new Directive which will incorporate important issues that affect the way treasurers operate both as users of financial instruments and as investors.

View More07 Jan 2011

EC Credit Ratings Response

The European Commission launched a consultation in November 2010 on credit ratings agencies. We have responded to the consultation and the full document can be read here. The EACT welcomes the Commission's initiative in publishing a working document for discussion and consultation purposes.

View More2010

13 Jul 2010

Response to the EC's Consultation on Regulation of Derivatives and Market Structures

It is vital that the approach taken to regulation of derivatives should be proportionate and recognise the essential role that these financial instruments play in allowing companies large and small to offset the financial risks they face in their business.

View More01 Jul 2010

EACT Comments in response to Public Consultation on Derivatives and Market Infrastructures

Why non-financial companies are fundamentally different in terms of the use of derivatives.

View More27 Apr 2010

EACT presentation to the ECON committee, European Parliament

On 27 April 2010 the EACT Chairman made a presentation to the ECON committee.

View More01 Apr 2010

Treasurers warn against allowing bank capital changes to reverse the progress achieved on derivatives regulatory proposals

The European Commission (EC) is being urged to ensure that companies are not forced to set aside potentially very large amounts of funding for risk management collateral by proposed changes to bank capital requirements.

View More01 Feb 2010

USA OTC Coalition for Derivatives End-Users Letter to all Senate offices

OTC derivatives provide companies with access to lower cost capital and protect against risk—enabling businesses to grow, make new investments and retain and create jobs.

View More01 Jan 2010

EACT: Leading European Companies unite against proposed OTC Derivatives Regulations

The EACT and end-users are concerned at the unintended consequences of the European Commission’s proposals.

View More2009

01 Sep 2009

EACT Survey on Borrowing Conditions post crisis

How borrowing conditions are affecting European businesses.

View More